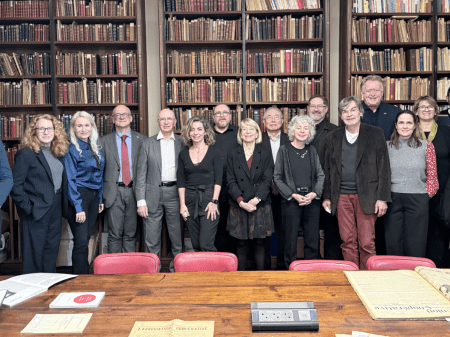

A Credit Union Interest Group has been launched in Brussels as a caucus for Members of the European Parliament (MEPs) who support credit unions. The group includes 15 MEPs from Poland, the Republic of Ireland, Austria, Finland and the United Kingdom.

They include European Parliament Vice-President Ryszard Czarnecki from Poland and MEP Marian Harkin of the Republic of Ireland, who will co-chair the group. MEP Richard Howitt of the UK will act as the group’s vice-chair.

The launch of the group coincided with European Network of Credit Unions’ (ENCU) bi-annual meetings in Brussels. The event also featured representatives from the Association of British Credit Unions Ltd (ABCUL) the Irish League of Credit Unions (ILCU), the National Association of Co-operative Savings and Credit Unions (NASCSU) of Poland, the Dutch Association of Co-operating Credit Unions (VSK) and the World Council of Credit Unions (WOCCU).

"We are honoured that so many prominent MEPs have come together to support credit unions and the important financial inclusion role they play in Europe," said Brian Branch, World Council president and chief executive. "It is these MEPs who have consistently supported credit unions and helped to maintain a regulatory environment in the EU that achieves safe and sound credit union regulation without imposing excessive compliance burdens that would make it difficult for credit unions to serve Europeans of modest means."

While in Brussels, ENCU members also met with the European Commission to discuss the EU’s upcoming rulemaking on the “Net Stable Funding Ratio” liquidity rules of Basel III and the Commission’s proposed directive on suitability standards for adjustable rate consumer lending.

The “Net Stable Funding Ratio” liquidity rules of Basel III requires banks and other institutions subject to Basel III to hold reserves of “high-quality liquid assets” to control for liquidity risk. Even though the NSFR was designed to apply to large banks, it indirectly affects credit unions that invest in term deposits because the NSFR’s reserve requirements make those deposits more expensive for banks or central credit unions to hold. The EU’s own version of the revised NSFR may be more favourable to credit unions than the revised NSFR of the Basel Committee on Banking Supervision.

The Commission’s proposal on financial products tied to an index could apply to some credit unions in Europe that make adjustable rate loans. ENCU members have asked the Commission and MEPs for greater clarity regarding when and to whom credit unions would need to give a disclosure. They have also raised questions as to what the legal effect of giving the disclosure would be.

According to Michael Edwards, vice president and chief counsel for advocacy at WOCCU, credit union representatives suggested that all consumer borrowers should receive a disclosure. They would welcome clear rules on how best to inform their members, who are also customers, about their credit unions’ loans.