By Balu Iyer

I recently took part in the 25th anniversary celebrations of the national Institute of Rural Baking (NIRB). Here I shared the stage with leaders from the banking and co-operative banking sectors in India, including Mr R. Gandhi, deputy governor of the Reserve Bank of India (RBI) and Dr R. Vishwanathan, National Institute of Rural Banking (NIRB).

In his inaugural address Mr R. Gandhi acknowledged the role played by co-operatives banks in financial inclusion and taking care of banking and credit needs of the lower and middle strata of society. He talked about the decline in co-operative character of banks and quoted a study conducted by the College of Agricultural Banking, Pune. The research pointed to low attendance in AGMs, restrictive practices in admitting new members, low voting turnout for election of new management, re-election of the same management or their family members, unanimous elections, and lack of meaningful discussions in AGMs. He observed that co-operatives, especially Urban Co-operative Banks (UCBs) are losing their co-operative character and that some of them have become 'too big to be a co-operative'. This got me wondering – if large banks are too big to fail, are co-operative banks - too big to be a co-operative?

The notion of “Too big too fail,” came to being following the bankruptcy of Lehman Brothers in September 2008 that triggered the financial crisis. Taxpayer bailouts were needed to prevent the “whole” financial system from collapsing.

In light of the above, what does “too big to fail” mean in the world of co-operative banking? This is answered in the research report by the European Association of Co-operative Banks, “European and Cooperative Banks in the Financial and Economic Turmoil: First Assessments.” It delineates five characteristics of the European co-operative banking model that have contributed to its resiliency. These are strong capitalisation, a business model that puts members and customers first, built-in anti-cyclical behaviour, tight bottom-up control mechanisms, and a democratic governance scheme. Among the anti-cyclical behaviour built-ins is a distinctive mechanism that has not only given co-operative banks’ the wherewithal to withstand systemic market shocks but has added resilience to the financial industry as a whole during times of financial crisis: the internal cross guarantee or institutional protection agreement. These agreements, integral to almost all European co-operative networks, require each independent co-operative bank to guarantee the deposits of all members of its network, thus providing an extra layer of protection to depositors in the event of a single bank’s failure. Indeed, the web of interdependence between co-operative members and co-operative customers, and between independent co-operative banks, gives new meaning to the phenomenon of “too big to fail.”

With the business growth, the politicisation of the sector also rose even though the urban co-operative banks are regulated and supervised by both the state governments, through the Registrars of Co-operative Societies, and the Reserve Bank of India. In 2005, the banking regulator stopped issuing fresh licenses to the urban co-operative banks and since than it has cancelled the licenses of many.

Mr. Gandhi was very vocal in what ails co-operative banks - reluctance in adapting new technology, decline in co-operative character, lack of professionalism and lack of corporate governance in co-operative institutions. He spoke about policy (CRR, SLR, prudential norms, Basal III norms) but omitted people and politics. In co-operatives, people are at the core and politics at the periphery; in reality though, the situation is reversed.

The remedies proposed by the RBI do not look at empowering people through transparency in information, education about their rights, communication about risks and working, making the banks managers and directors accountable to members, and developing rating systems for co-operative banks to make the member better informed. The diagnosis of what ails the co-operative banks has been well made; however the treatments proposed fall short and could well kill the co-operatives, good and bad.

The ICBA, a sectoral organisation of the ICA, took part in a Round Table Discussion in Mumbai in April. ICBA and the National Federation of State Cooperative Banks Limited (NAFSCOB) will look into issues that have been holding back co-operative banks from achieving their full potential and bring these to the attention of RBI, NANARD and policy makers in an event planned for 2016.

I would like to end by quoting Mr Gandhi: “To keep the spirit of democracy alive, urgent steps need to be taken by the institutions themselves to keep co-operatives relevant to their members.” I would add RBI and NABARD to consider themselves as key institutions to sustain the co-operative banks.

Balu Iyer is the regional director of the International Co-operative Alliance for Asia-Pacific

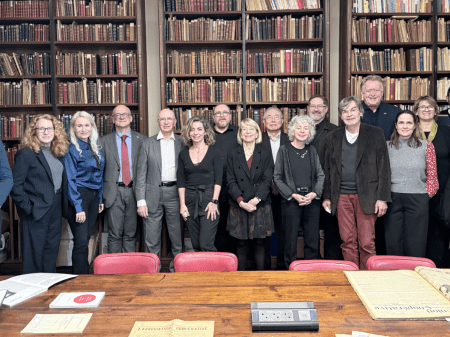

Photo: premises of reserve Bank of India