The World Council of Credit Unions (WOCCU) and the European Network of Credit Unions (ENCU) have joined efforts to advocate before European Union officials for better legislative and regulatory outcomes for credit unions in the run up to the 2014 European Parliamentary elections.

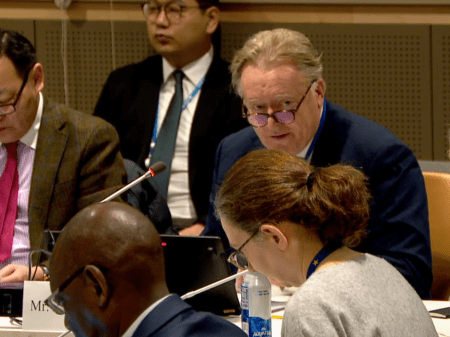

Representatives from ENCU, along with WOCCU’s board of directors, debated with EU policymakers the implementation of the Basel III liquidity rules. They also touched upon a draft EU directive on the automatic exchange of tax information, which is modelled on the United States’ Foreign Account Tax Compliance Act (FACTA).

Various ENCU member organisations took part in the Brussels meeting, including the Association of British Credit Unions (ABCUL), the Estonian Union of Credit Cooperatives, FULM Savings House of Macedonia, the Irish League of Credit Unions and the National Association of Co-operative Saving and Credit Unions (Poland).

According to Brian Branch, the president and chief executive of WOCCU, European credit unions face complex regulatory challenges that require constant communication with regulators and policymakers to protect the interest of credit unions.

“With ENCU’s help, World Council will continue giving credit unions a global voice to influence standards that apply at national, regional and international levels”, he said.

In a meeting with Marian Harkin, Irish member of the European Parliament (MEP) and vice president of the European Democratic Party, the group looked at effective strategies to achieve positive credit union legislation in light of the upcoming elections. Ms Harkin encouraged efforts to raise awareness about credit unions with MEPs and the European Commission.

WOCCU and ENCU representatives also examined the European Banking Authority’s report to the European Commission.

The Basel III Agreement introduces two new liquidity ratios that are intended to ensure that banks hold sufficient liquidity aside for crisis situations. This could place an extra burden on credit unions.

At a meeting with Commission officials, the group highlighted the report findings of the European Banking Authority’s report to the Commission, which recommends revisiting the Basel III liquidity rules to help credit unions maintain access to favourable yields on banks term deposits.

ENCU and World Council also met with Commission and EU Council representatives to discuss EU’s draft tax information reporting directive modelled on FACTA, which the EU plans to implement by 2017.

While in Brussels, World Council of Credit Unions made recommendations to the Financial Action Task Force (FATF) on how to limit regulatory burdens on credit unions, as FATF is working to update its current risk-based approach for banking institutions guidance paper. World Council's comments focused on limiting regulatory burdens on small and medium financial institutions, as well as helping credit unions maintain access to correspondent banking services.

Photo (c) WOCCU: (From left to right) Paweł Grzesik, National Association of Cooperative Savings and Credit Unions director of Warsaw office (Poland); Brian Branch, World Council president and CEO; Grzegorz Bierecki, World Council chairman; Marian Harkin, MEP (Ireland); Brian McCrory, World Council director and Irish League of Credit Unions treasurer.