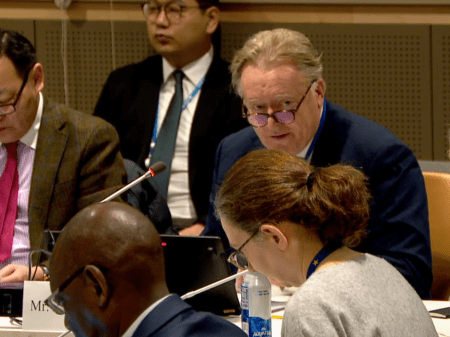

What is the relationship between access to capital and ownership based participation in co-ops? Arnold Kuipers, director of Rabobank in Europe describes it as “a tense one”.

On 11 January 2017 Mr Kuipers spoke at a roundtable in London organised by Co-operatives UK, the Building Societies Association and the Association for Financial Mutuals.

He explained how in practice co-ops needed more capital than members could or were willing to invest. Outside providers of capital would want some degree of control over the business, but in co-ops members run the business on the principle of one member, one vote.

Mr Kuipers talked about Rabobank’s experience. The financial co-op has recently developed a model for member shares, as a minority of their capital base built on retained earnings – which is now sold to institutions outside. His presentation is available online.

Writing about Mr Kuipers’ presentation, Ed Mayo, secretary general of Co-operatives UK, said: “The headline conclusion was that there is no avoiding the trade offs if you need capital. But there is a lot of room for manoeuvre in terms of designing the approach you take to avoid the risks, and in structuring your business around a true understanding of the full costs and opportunities of external capital.”

Photo: Arnold Kuipers, director of Rabobank in Europe.