[[{"type":"media","view_mode":"media_original","fid":"12986","attributes":{"alt":"","class":"media-image","height":"480","typeof":"foaf:Image","width":"344"}}]]

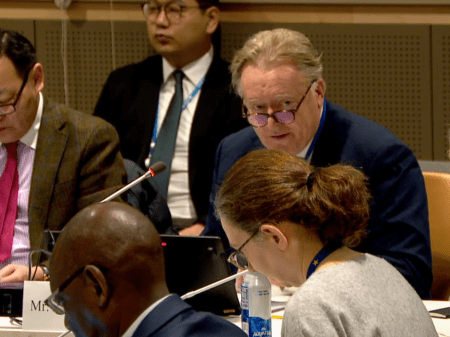

Representatives from credit unions met with Members of the European Parliament to examine how credit unions can help promote financial inclusion and what regulatory challenges prevent them from achieving this. Created earlier this year, the European Parliament Credit Union Interest Group includes 15 Members of the European Parliament (MEPs) who sit on the Economic and Monetary Affairs (ECON) Committee.

The meeting enables credit union leaders to engage with the group of MEPs and share their concerns regarding compliance burdens. While they are smaller than European banks and are less likely to take part in risky financial activities, credit unions are subject to many EU directives and regulations designed to address problems within the banking sector. Legislation that impacts on credit unions usually falls under the ECON Committee's jurisdiction.

Participants looked at specific examples of credit unions promoting financial inclusion and regulatory burden challenges in Estonia, Great Britain, Ireland, the Republic of Macedonia, Poland and Romania. They also touched upon the impact of banking regulation on credit unions as bank customers, even when they are exempt from a specific banking rule. Under the Basel III liquidity rules' requirement banks have to increase their reserves held against deposits made by credit unions, which reduced the yields that credit unions earn on investments in bank term deposits in the Republic of Ireland, as well as in Poland, Romania, and Macedonia.

MEPs and credit union leaders also examined government initiatives that help support credit unions' financial inclusion efforts, such as the British government's Credit Union Expansion Project, which has attracted an investment of £38m into the sector. The project was managed by the British Association of Credit Unions (ABCUL) and has enabled credit unions to offer a wider range of products to more members from different income groups.

Speaking at the meeting, European Parliament vice president, Ryszard Czarnecki urged credit unions to continue the dialogue with the Group in order to prevent overregulation of credit unions at European level as well as make it easier for credit unions to provide their members with loans, savings and other financial services at reasonable rates.

Photo: ENCU meeting - Eleonora Zgonjanin, FULM Savings House (Macedonia); Ryszard Czarnecki, European Parliament Vice President (Poland); and Pawel Grzesik, NACSCU (Poland) (c) WOCCU