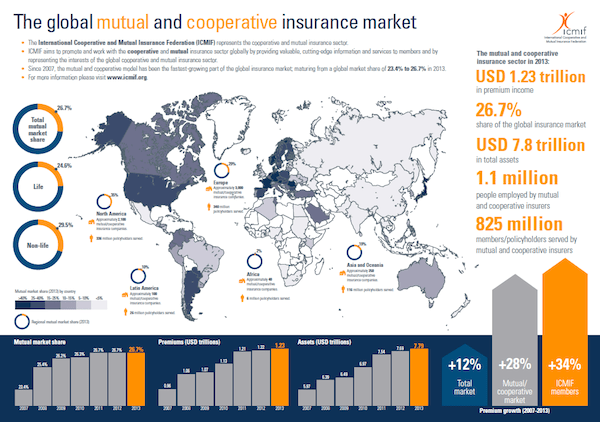

The International Co-operative and Mutual Insurance Federation (ICMIF) unveiled a new report that shows how co-operative and mutual insurers choose to present themselves and how they are perceived by non-stakeholders.

The co-operative and mutual insurance sector represents 26% of the world’s insurance market. The report, which was unveiled at the International Summit of Cooperatives in Quebec, is aimed at allowing co-operative and mutual insurers to better understand how to enhance their reputation, whether individually or collectively. It looks at three key aspects: quality of reputation; strength of reputation; and drivers of reputation.

ICMIF commissioned Reputation Consultancy to carry out the survey in 2012. The research covered 99% of ICMIF members and was undertaken in 16 languages over a 12 months period.

According to the report, better reputation is connected to a sustained financial performance. It also highlights that co-operative and mutual insurers have the opportunity to make their voices heard and differentiate themselves from competitors by collectively raising the sector’s visibility.

Another finding of the report is that external stakeholders do not recognise a significant difference between co-operative/mutual and shareholder based insurers. One explanation for this could be that stock insurers are creating strong associations with themes such as sustainability and corporate citizenship and a high degree of success. Co-operative and mutual insurers should devise a unified message that highlights the sector’s core values, argues the report. It also adds that they are more likely to be heard if they engage in conversations around social issues relating to insurance such as ageing populations, natural disasters, terrorism and climate change.

In addition to speaking with a single voice, co-operative and mutual insurers should also engage with key influencers, such as business analysts, international organisations of governments.

The report also suggests some financial reputation themes that co-operative and mutual insurers could explore. According to the research, messages about growth are being linked to financial success; environmental themes focus on rewarding positive behaviours and reducing environmental impact; social themes work best when they are linked to the key social conversations.