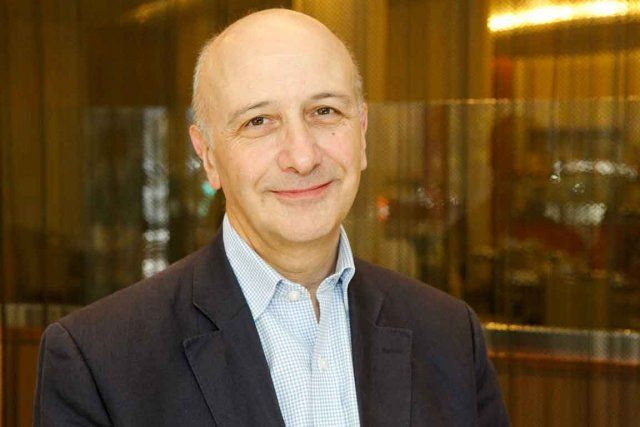

Good afternoon, Mr Bancel. We understand that you are representing co-operative banks before the B20, as a member of the Alliance's B20 delegation. Can you tell us a little more about the opportunities for co-operative banks today, and which policy recommendations will likely be put forward?

Jean-Louis Bancel: After the B20 summit in Sidney last year, I became further involved in the Alliance's B20 representation project. I registered to take part in two B20 coalition groups, where I believe co-operative banks can play an important role. They are "financing growth" and "inclusive business". The first objective for the Alliance's delegation is to prevent a "one size fits all" government policies.

We need world leaders to understand that co-operatives are an alternative next to the big public limited companies, and could be the solution to sustainably grow the economy. As their colleague, I will clarify the place of co-operatives in a diverse economy. This "business diversity" is very important for the resilience of economy.

Moreover, co-operatives bring a tremendous advantage for world leaders. We are really "glocal", that is to say we are active at local level through primary co-operatives, and we are at the same time global through the Alliance’s structures. That explains why I am involved in these two groups: one for global matters: "financing growth", the other one for the local matters "inclusive business".

Mr Bancel, co-operative banks are a very diverse sector, having both small banks and some of the biggest. Could you tell us more about the role they play for funding SMEs and local businesses?

JLB: You are right, the co-operative banks' sector is very diverse. It extends from small local credit unions to big players such as Desjardins or Crédit Agricole. But whatever the size, it is important to understand that they all have in common their involvement in the real economy, from financing people's housing to granting loans to SMEs.

This investment in real economy explains broadly why co-operative banks were so resilient during the financial crisis. This is very well pointed out in a research paper published by the ILO on this topic. In this research co-operative banks were shown to be more resilient during the financial crisis than traditional banks. Their involvement in the real economy explains this. As a consequence, these banks might be less affected by a major economic crisis. This is why we are worried to see that the regulators are not taking into account the special nature of co-operative banks when setting rules for the sector.

Last year the largest European banks were subjected to a stress test and an asset quality review. How did co-op banks perform in this test? Were there any weaknesses identified? Do they have what it takes to withstand future shocks?

JLB: Last year the ECB has published the results of tests conducted on their portfolio of loans and their financials liabilities. This test was only conducted on the larger banks. As a consequence, only a few co-operative banks being members of systemic groups or considered as systemic due to their size, were included. In general, co-operative banks were successful in passing the test. It is no surprise - you have to remember that the IMF study published in 2007 on the co-operative banks described them as very conservative in terms of their loan policy and even as overcapitalised. I know that this opinion expressed by the IMF at that time might today be considered strange. In some cases a few of co-operative banks have to strengthen their finances. In some instances it might lead to mergers to reach a better financial profile.

Mr Bancel, a number of regulatory changes have been introduced following the financial crisis, not only at EU level, but also at global level with the Basel III agreement. Have reforms brought changes to co-op banks, regarding capital levels and liquidity? How are smaller co-op banks responding to the burden of legislation and regulation?

JLB: It has at times been difficult to make regulatory authorities listen to us. For example the London G20, which launched the increase of capital requirement for the banks, asked the Basel Committee to take into account the diversity of the legal or economic models in the banking sector.

Despite the request from co-operative banks, the definition given for capital did not include co-operative shares. As a consequence, we have to convince the national regulators that the co-operative shares are an eligible component of the capital. We succeeded in Europe. I hope it will be the same in other parts of the world.

It is sometimes a long process to convince the regulators to take into consideration the special characteristics of co-operative banks. Some regulators pretend it is not possible because it would breach the "level playing field". This is obviously not true. Their denial to take into account the people’s choice and the legislator's decision is either a denial of democracy or a hidden ideological policy to impose a “no choice” strategy.

This is exactly what is happening in Italy, where the government has decided that the "Banco Popolaro" with a balance sheet of over €8bn will be converted, without any vote from the members, into PLCs. It is an unsound decision and the ICBA is ready to help these co-operative banks in their legal battle.

Jean-Louis Bancel is president of Crédit Coopératif and chair of the International Co-operative Banking Association (ICBA).