A report by the Filene Research Institute looks at how to increase the status of women’s leadership within the credit union sector. The report is based on a research conducted by Melissa Thomas-Hunt and Mahak Nagpal of the University of Virginia, in collaboration with the Filene Research Institute and the World Council of Credit Unions.

The authors looked at dozens of specific factors that support or inhibit women’s leadership within credit unions. To support the research, they carried out a survey of credit union employees and board members in the USA, Canada and Mexico. The 76-question survey revealed five key challenges to advancing women’s leadership in credit unions.

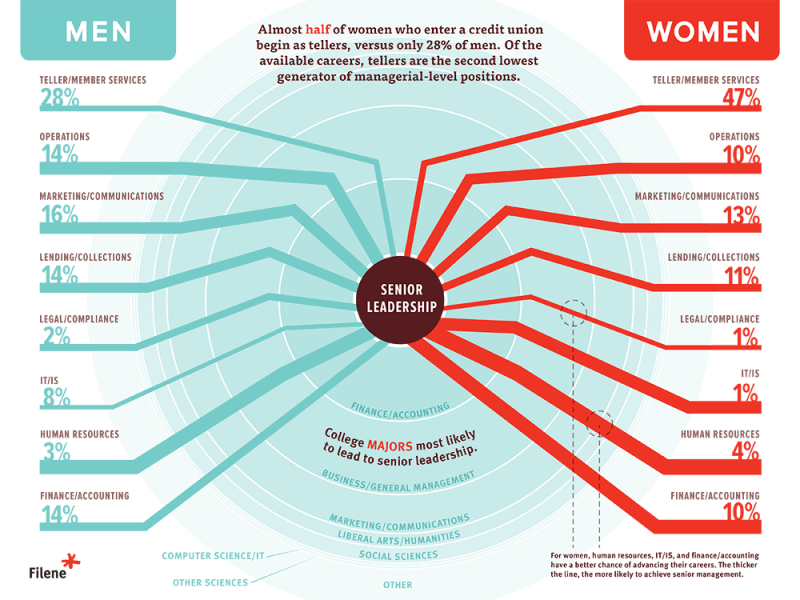

One of these is the fact that women often start working for credit unions in lower level roles and in departments that do not lead directly to executive positions. Almost half of women who enter a credit union begin as tellers, as opposed to only 28% of men. Women perceive themselves as having less power and influence than men, which can also become a barrier. According to the survey, women are perceived to use slightly more authoritarian leadership styles across credit unions.

The existing leadership climate can pose another challenge. The research reveals that employees at credit unions with female chief executives perceive themselves differently and act differently than those at similar credit unions where a man is in charge. Furthermore, men feel that their skills are significantly more valued when there is a male chief executive, while women feel more valued working for other women.

In terms of ambition and motivation, mentors and mentees tend to group toward their own gender. With men more likely to hold senior credit union positions, it can be more difficult for women to get a hand up.

Respondents did not report family as a career inhibitor. However, at senior level men are more likely to have children (59% men in high level manager positions have children) and women more often seem to make trade-offs between career and family (41% of women in high manager positions have children).

Commenting on the research, Filene Chief Executive, Mark Meyer, said: “The research is not done. This collaboration with the World Council shows us the challenges we face in credit unions, especially matching sponsors early on. The real work will come when leaders, men and women alike, take these challenges personally and resolve to overcome them.”

Calyn Ostrowski, executive director of the Worldwide Foundation for Credit Unions, added: “We need the credit unions movement to step forward and unlock the leadership potential of women. This is at the heart of what we do through the Global Women’s Leadership Network”.