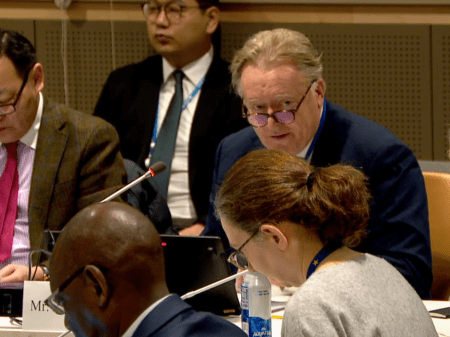

A group of Members of the European Parliament (MEPs) met in Brussels to examine how regulation was affecting credit unions. The MEPs form part of the European Parliament Credit Union Interest Group a discussion caucus launched in December 2014.

The event featured keynote speeches from Dr Barry Quinn, Lecturer of Finance at Queen’s Management School, Queen’s University Belfast in Northern Ireland, and Michael Edwards, vice president and general counsel of the World Council of Credit Unions.

Dr Quinn talked about the burden placed by regulation on credit unions in the United Kingdom and the Republic of Ireland. He referred to data that showed how credit unions in the two countries had moved from a position of increasing returns relative to scale, to a position of decreasing returns relative to scale, in large part because of increased regulatory burdens.

Mr Edwards argues that changes to EU regulation could help the European economy by allowing credit unions to increase their lending to consumers and small and medium enterprises.

“Today’s discussion can be the starting point for a deeper reflection on how best to promote growth in Europe through regulatory reforms that unlock the full potential of credit unions and improves the lives of their members,” said Mr Czarnecki. “As co-operative deposit-taking institutions that are owned by their customers, credit unions are the perfect financial institution for promoting fair and equitable economic growth for ordinary Europeans.”

Photo: From left, Liam Morris (Permanent Representation of Ireland to the EU), Dr. Barry Quinn (Queens University Belfast), Ed Farrell (Irish League of Credit Unions), Hilary O’Sullivan (Irish League of Credit Union), MEP Brian Hayes (Ireland), and Pat Fay (Irish League of Credit Unions) (c) WOCCU