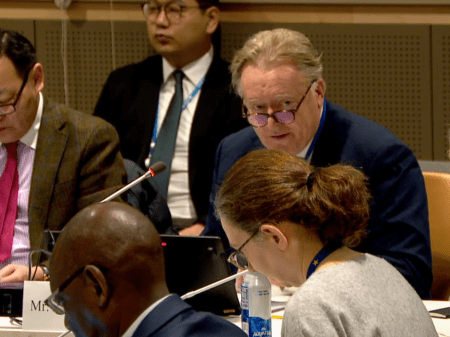

Credit union representatives engaged with senior members of the Basel Committee Secretariat to discuss how to reduce regulatory burdens on credit unions. The meeting, which took place on 19 January, also featured William Coen, the secretary general of the Basel Committee on Banking Supervision (BCBS).

Credit union leaders asked the Basel Committee to reduce the regulatory burdens on credit unions by carving out non-internationally active institutions like credit unions from Basel Committee standards. They also suggested establishing a working group focused on considering the potential impact of proposed Basel Committee standards on community-based financial institutions.

Set up in 1975, the Basel Committee on Banking Supervision is a forum for regular cooperation on banking supervisory matters, which also develops banking guidelines and supervisory standards.

“We believe that carving out locally focused financial institutions from Basel Committee standards is one of the best ways to limit regulatory burdens on credit unions and other community-based financial cooperatives,” said Michael Edwards, vice president and general counsel of the World Council of Credit Unions. “Credit union regulators frequently look to Basel Committee standards even if they are not required to implement Basel Committee rules on locally focused institutions per se." The full report of the meeting is available on WOCCU’s website.

Photo: WOCCU representatives engaging with the Basel Committee (c) WOCCU